The adoption of stablecoin has exploded over the few months. CoinMarketCap places their market cap rise from around $10 billion to over $100 billion. This is partly amplified by yield generating opportunities from DeFi market boom and growing interest in digital assets,to provide tokenized and frictionless benefits of moving between crypto and fiat over permissionless blockchains.

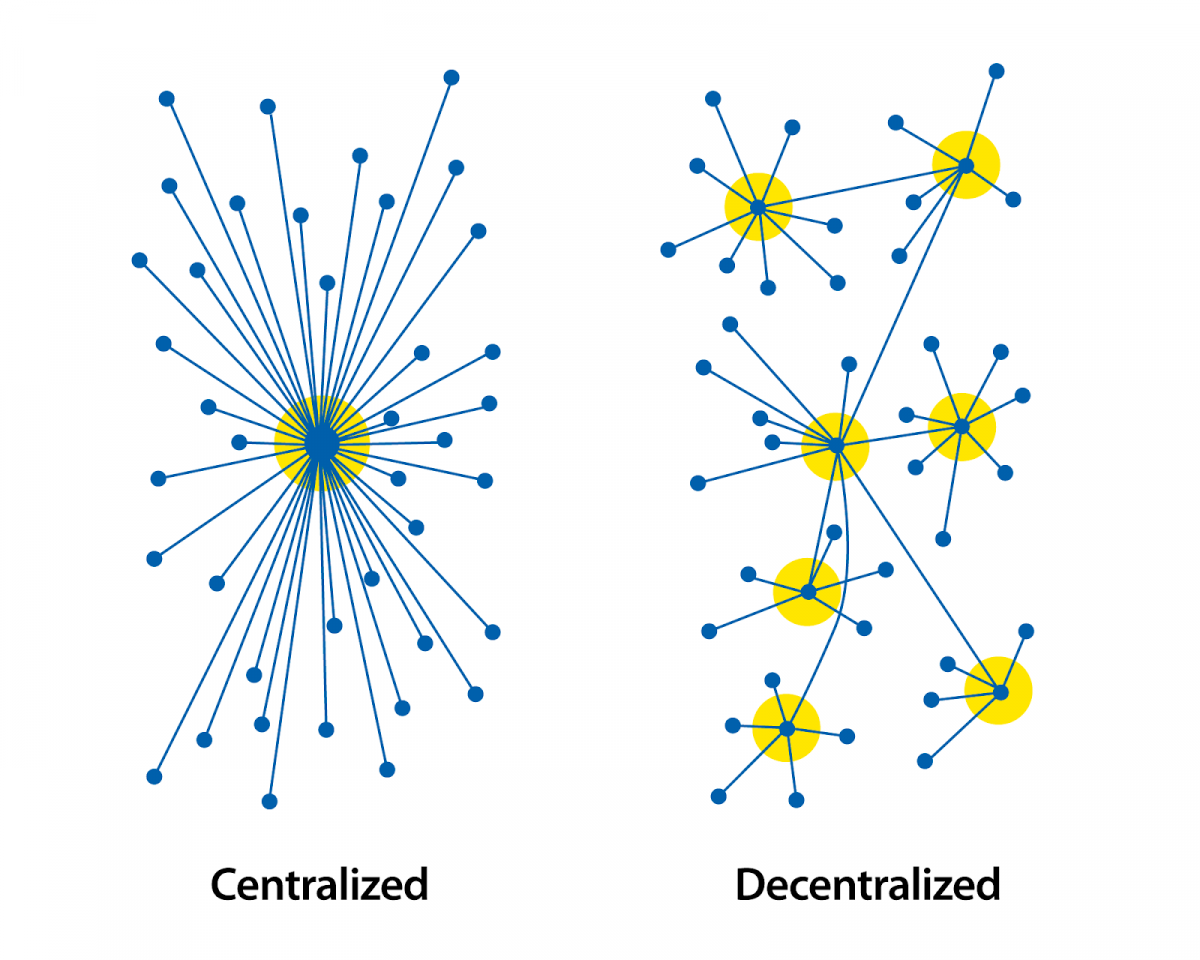

Stablecoins can be broadly categorized into two architectures; centralized and decentralized models. This article will seek to explain the technical architectures of these two models.

Centralized Stablecoins

Centralized stablecoins are custodial stablecoins, generally fiat collateralized off-chain. Their stability is achieved through equal backing of token liabilities with a corresponding asset, either directly or through a third-party custodian like a bank, creating a bridge between traditional finance and the crypto world.

Examples of centralized stablecoins include; True USD (TUSD), Pax Standard (PAX), Binance USD (BUSD)

How are centralized stablecoins minted and redeemed?

The minting and redemption costs of these stablecoins can be high because they are compounded by the custodian’s operational, audit, and compliance costs. Slow and expensive connections to legacy banking systems also amplify these costs. The centralized nature of the custodian can also create a single point of failure that is open to censorship.

Decentralized Stablecoins

Decentralized stablecoins can be further divided into crypto-collateralized and algorithmic stablecoins.

Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins swap the fiat-collateralized concept for cryptocurrencies, transferring the minting and redemption mechanism on-chain with an incentive mechanism to maintain the peg. This can create a blockchain-native alternative that takes on the decentralized nature of the network on which they are built. In addition, due to the volatility of crypto, these models achieve stability by allowing lenders to generate interest from borrowers.

The general shortcomings of decentralized and crypto-collateralized stablecoins are the scalability issues of the dominant Ethereum base layer, oracle manipulation, volatility risks, as well as the need to dedicate too much collateral.

Algorithmic Stablecoins

Algorithmic Stablecoins are designed to achieve price stability and balance the circulating supply of the base asset by being pegged to some reserve asset, e.g., the US dollar, gold, or any other foreign currency.

These stablecoins use an underlying algorithm that issues more coins if the price increases and buys them off the market if the price falls. These coins give traders the comfort to reap the benefits of crypto assets like BTC and ETH without the risk of price volatility.

Summary

Stablecoins are being used to scale the mass adoption of their underlying blockchains. This article discusses their different architectures, which entail decentralized designs, cross-chain compatibility features, and robust peg mechanisms to protect against volatility, and deployed within a scalable, efficient, and trustless environment.